The Basic Principles Of Home Renovation Loan

Wiki Article

Some Known Facts About Home Renovation Loan.

Table of ContentsThe smart Trick of Home Renovation Loan That Nobody is DiscussingNot known Factual Statements About Home Renovation Loan Home Renovation Loan Fundamentals ExplainedHome Renovation Loan Fundamentals ExplainedGetting The Home Renovation Loan To WorkAn Unbiased View of Home Renovation Loan

If you are able to access a lower home mortgage price than the one you have currently, refinancing might be the most effective choice. By utilizing a mortgage re-finance, you can possibly free the funds required for those home restorations. Super Brokers mortgage brokers do not bill fees when in order to give you financing.Also better, repayment alternatives are up to you. These repayments can be made month-to-month, semi-monthly, bi-weekly, bi-weekly accelerated, and weekly.

An Unbiased View of Home Renovation Loan

Credit report card interest can intensify promptly which makes it definitely harder to pay off if you aren't certain that you can pay it off in short order (home renovation loan). Despite limited-time low rate of interest deals, charge card passion rates can climb. On average, bank card rate of interest can strike around 18 to 21 percent

Unlike standard home mortgage or personal fundings, this form of funding is tailored to attend to the costs connected with home improvement and remodelling tasks. It's an excellent option if you intend to enhance your home. These car loans come in handy when you wish to: Improve the visual appeals of your home.

Raise the overall worth of your home by updating areas like the kitchen area, washroom, or perhaps adding brand-new areas. A Remodelling loan can have lots of advantages for debtors. These can include: This suggests that the car loan quantity you get approved for is identified by the forecasted rise in your residential property's worth after the improvements have been made.

Fascination About Home Renovation Loan

That's since they commonly include reduced rates of interest, longer settlement periods, and the capacity for tax-deductible rate of interest, making them an extra cost-effective remedy for moneying your home enhancement restorations - home renovation loan. A Remodelling finance is ideal for home owners that intend to change their space as a result of the adaptability and benefitsThere are a number of reasons that a property owner may intend to secure a renovation car loan for their home improvement job. -Undertaking remodellings can considerably enhance the value of your residential property, making it a smart financial investment for the future. By enhancing the aesthetic appeals, functionality, and general appeal of your home, you can expect a greater return on financial investment when you determine to sell.

This can make them a much more cost-effective means to finance your home renovation projects, lessening the general financial concern. - Some Home Improvement financings provide tax deductions for the rate of interest paid on the car loan. This can help in reducing your gross income, providing you with additional savings and making the finance a lot more economical in the future.

Some Known Factual Statements About Home Renovation Loan

- If you have multiple home renovation tasks in mind, an Improvement car loan can aid you settle the costs right into one workable finance settlement. This permits you to streamline your finances, making it easier to track your expenditures and budget successfully. - Remodelling car loans frequently feature flexible terms and repayment choices like a 15 year, twenty years, or thirty years car loan term.

- A well-executed restoration or upgrade can make your home much more attractive to potential customers, improving its resale possibility. By purchasing top quality upgrades and enhancements, you can bring in a broader series of potential customers and raise the probability of safeguarding a desirable price. When considering a remodelling funding, it's important to recognize the various options available to discover the one that finest fits your needs.

Equity is the distinction in between your home's current market value and the quantity you still owe on your mortgage. Home equity finances commonly have actually taken care of rates of interest and settlement terms, making them a redirected here predictable option for property owners. is comparable to a charge card in that it provides a revolving credit line based on your home's equity.

After the draw period finishes, the repayment phase begins, and you have to pay off the borrowed quantity over time. HELOCs usually come with variable passion prices, which can make them less predictable than home equity lendings. is a government-backed home mortgage insured by the Federal Housing Management that incorporates the cost of the home and restoration costs right into a solitary car loan.

The 5-Second Trick For Home Renovation Loan

With a reduced down settlement need (as reduced as 3.5%), FHA 203(k) loans can be an appealing option for those with restricted funds. another option that permits borrowers to fund both the purchase and remodelling of a home with a single home mortgage. This loan is backed by Fannie Mae, a government-sponsored business that supplies home loan financing to loan providers.Additionally, Title I financings are readily available to both homeowners and property owners, making them a flexible alternative for numerous circumstances. A Lending Police officer at NAF can respond to any questions you have and assist you understand the various types of Home Renovation financings offered. They'll additionally assist you locate the ideal choice fit for your home enhancement requirements and monetary circumstance.

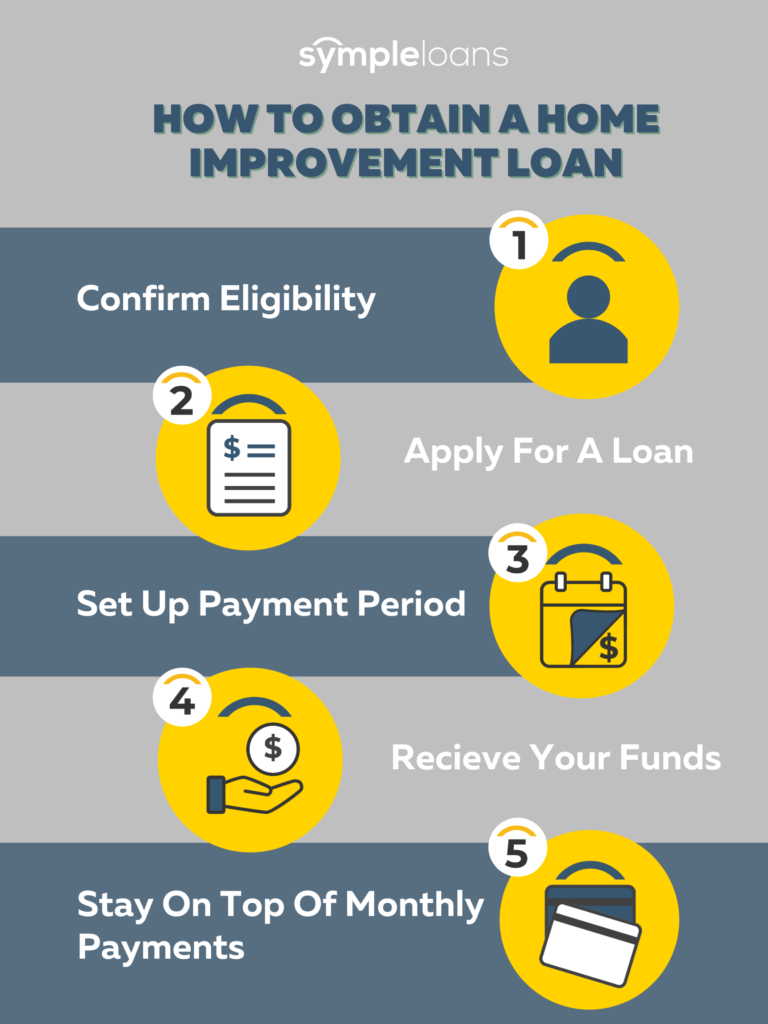

For instance, if you're wanting to make energy-efficient upgrades, an EEM may be the most effective choice for you. On visit this web-site the various other hand, if you're an expert and desire to purchase and refurbish a fixer-upper, a VA Improvement Lending could be a suitable option. There are a number of steps involved in securing a home renovation lending and NAF will assist direct you via every one of them.

The 2-Minute Rule for Home Renovation Loan

This will certainly help you establish the general find more budget plan and recognize the proper type of remodelling lending. Consider factors like the scope of the job, price of materials, possible labor costs, and any type of backup prices. - Your credit report plays a substantial duty in securing a restoration loan. It affects your lending eligibility, and the rate of interest loan providers provide.A higher credit scores rating may result in better financing terms and lower passion rates. - Put together vital documents that lending institutions require for loan authorization.

Report this wiki page